The Basic Principles Of Do I Have To List All My Assets and Debts When Filing Bankruptcy?

Creditors will generally halt calling even prior to the bankruptcy is submitted in case you retain an attorney to file for bankruptcy safety, and you also advise the creditor of that fact.

four moment go through • Upsolve is really a nonprofit that helps you receive from credit card debt with education and absolutely free credit card debt relief instruments, like our bankruptcy filing Device.

As soon as the prepare is productively carried out, you will often get a discharge from the remaining dischargeable debts. At the moment, the situation is shut in bankruptcy courtroom.

Get hold of us today and established your family back again on a path to economic flexibility. You’ll receive a prompt reaction from Jeanne Hovenden or David Ostwinkle, who will solution your queries and plan a totally free, no-obligation consultation.

If you are self-employed and filing for bankruptcy, you'll probably have to have to deliver a year-to-date gain and reduction statement and The 2 whole many years in advance of filing. Also, be ready to present enterprise lender statements to confirm the revenue and reduction amounts.

Most creditors will learn about your bankruptcy even should they aren’t listed as part of your sorts. Leaving a credit card debt out received’t increase your chances of holding collateral or maybe a credit card.

Also, You'll have to supply selected files to your bankruptcy trustee to confirm the precision of the knowledge presented.

No. In some instances where by only one spouse has debts, or just one husband or wife has debts that aren't dischargeable, then it'd be advisable to have only one spouse file. Nonetheless, although just one husband or wife documents, that husband or wife will have to report their read review partner’s income so as to determine whether the home has sufficient indicates to repay creditors at the least a little something (the ‘means test’) throughout the training course in the bankruptcy. See subsequent query.

In many states, in case you don’t have assets which might be seized by creditors, it’s not the end of the entire world should you fail to remember to list a financial debt in your bankruptcy kinds In order for you that financial debt for being erased.

Chapter seven is the most typical form of bankruptcy filing. Liquidation of assets may manifest, but nearly all of these scenarios require debtors with no assets. Unsecured creditors are entitled to merely a portion of the things they are owed.

Some debts are certainly not documented to the credit score bureaus right away (or in the least) and in order that they won’t exhibit up on your credit score report. Here are several supplemental points to search for when planning a list of your respective debts go to my blog for your Chapter 7 bankruptcy.

Thanks to these issues, filing for bankruptcy early is nearly always most effective. The exception could be In case the creditor is definite to file an adversary continuing in bankruptcy courtroom, and the end result would probably be worse in federal instead of state court docket.

You should Take note that every one phone calls with the company could be recorded or monitored for good quality assurance and teaching uses. *Shoppers who are able to stay with the program and acquire all their debt settled notice approximate personal savings of 46% ahead of costs, or twenty five% a knockout post like our charges, more than 24 to 48 months. All statements are based upon enrolled debts. Not all debts are eligible for enrollment. Not all clients complete our software for various motives, including their capability to conserve ample money. Estimates based on prior effects, which can differ dependant on distinct circumstances. We do not warranty that your debts will be lowered by a try this certain amount or percentage or that you'll be debt-cost-free within a particular timeframe.

It's common to want to select and select the debts you contain in the Chapter 7 case, but it's not authorized. It's essential to transparently list everything you owe, which include obligations on your grandmother, best friend, ex-wife over here or husband, or business enterprise husband or wife. The rule prevents filers from:

Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Suri Cruise Then & Now!

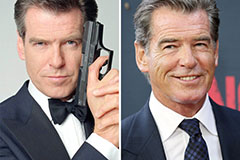

Suri Cruise Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!